Poverty Elimination and Upliftment of Living Standard Through Microfinance (A Case Study of Selected Districts of Uttar Pradesh)

DOI:

https://doi.org/10.26703/JCT.v16i2-13Keywords:

Per Capital Income, Unemployment, Microfinance, Inclusive Financial ActivitiesAbstract

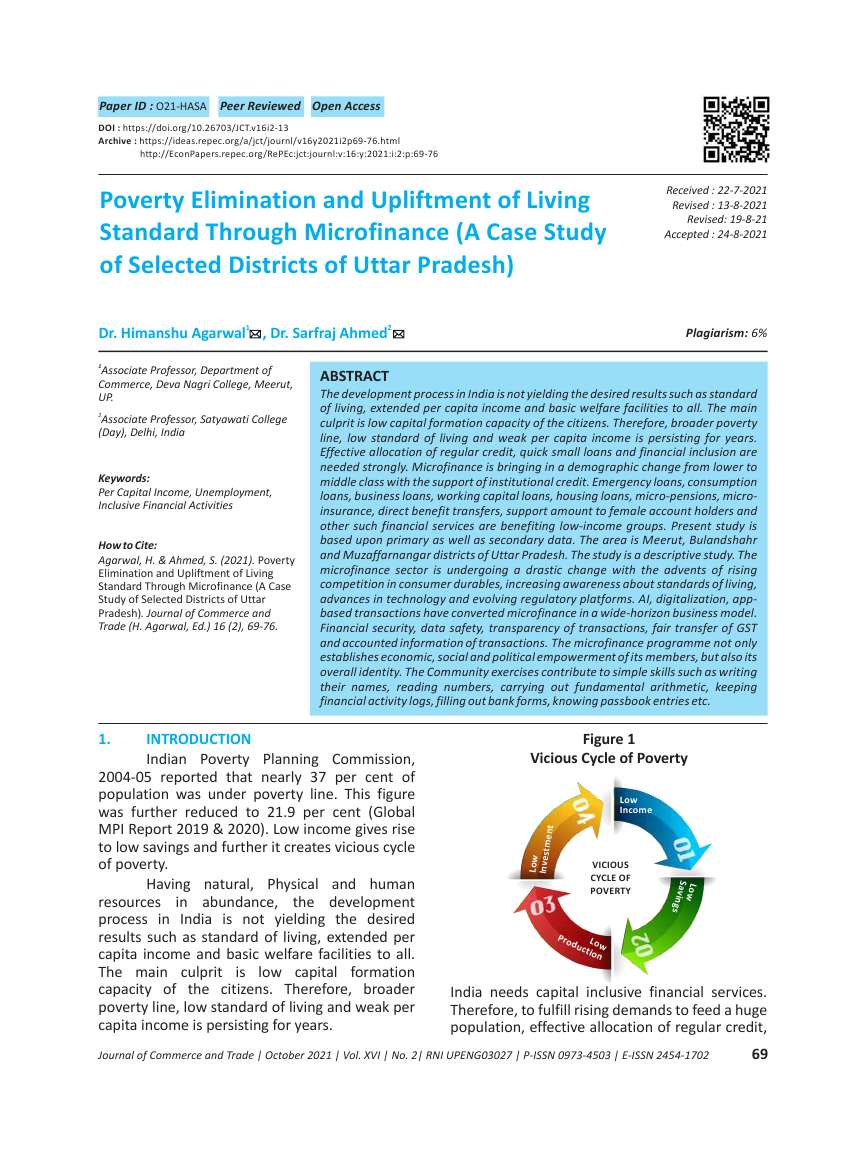

The development process in India is not yielding the desired results such as standard of living, extended per capita income and basic welfare facilities to all. The main culprit is low capital formation capacity of the citizens. Therefore, broader poverty line, low standard of living and weak per capita income is persisting for years. Effective allocation of regular credit, quick small loans and financial inclusion are needed strongly. Microfinance is bringing in a demographic change from lower to middle class with the support of institutional credit. Emergency loans, consumption loans, business loans, working capital loans, housing loans, micro-pensions, micro-insurance, direct benefit transfers, support amount to female account holders and other such financial services are benefiting low-income groups. Present study is based upon primary as well as secondary data. The area is Meerut, Bulandshahr and Muzaffarnangar districts of Uttar Pradesh. The study is a descriptive study. The microfinance sector is undergoing a drastic change with the advents of rising competition in consumer durables, increasing awareness about standards of living, advances in technology and evolving regulatory platforms. AI, digitalization, app-based transactions have converted microfinance in a wide-horizon business model. Financial security, data safety, transparency of transactions, fair transfer of GST and accounted information of transactions. The microfinance programme not only establishes economic, social and political empowerment of its members, but also its overall identity.

Downloads

References

Amin, R.; Becker, S.; and Bayes, A. (2012), “NGO-Promoted Micro credit Programs and Women's Empowerment in Rural Bangladesh: Quantitative and Qualitative Evidence”, The Journal of Developing Areas, Vol. 32, No. 2, pp. 221-36.

Dr. Kaushal A. Bhatt and Mr. Amit A. Rajdev, (2012), An Analysis of Factors Empowering Women Through Microfinance, PARIPEX – Indian Journal of Research, Volume: 1 | Issue: 11 | November 2012.

Ewubare, D.B., & Okpani, A.O. (2018). Poverty and income inequality in Nigeria (19802017). International Journal of Advanced Studies in Ecology, Development and Sustainability, 5(1), 138-151.

Faress Bhuiyan, Muhammad; Ivlevs, Artjoms (2018). Micro Entrepreneurship and Subjective Well-Being: Evidence from Rural Bangladesh, IZA Discussion Papers, No. 11819, Institute of Labor Economics (IZA), Bonn.

Ho, S.Y., & Odhiambo, N.M. (2011). Finance and poverty reduction in China: an empirical investigation, International Business & Economics Research Journal, 10(8), 103-114.

Ihugba, O.A., Bankong, B., & Ebomuche, N.C. (2013). The impact of Nigeria microfinance banks on poverty reduction: Imo State experience. International Letters of Social and Humanistic Sciences, 16, 92-113.

Ilegbinosa, I.A., & Opara, G.I. (2014). Microfinance and its impact on poverty alleviation: a case study of some microfinance banks in Edo state, Nigeria. American Journal of Humanities and Social Sciences, 2(1), 27-41.

Kaidi, N., Mensi, S., & Amor, M. (2019). Financial development, institutional quality and poverty reduction: Worldwide evidence. International and Interdisciplinary Journal for Quality-of-Life Measurement, Springer, 141(1), 131-156.

Microfinance Institution Networks. (2015). Annual Report of Microfinance Institution Network. Gurgaon. Retrieved from http://mfinindia.org/wp-content/uploads/2015/08/MFIN_Annual Report -2015.pdf

Modi, Ashwin & Patel, Mr & Patel, Kundan. (2014). Impact of Microfinance Services on Rural Women Empowerment: An Empirical Study. IOSR Journal of Business and Management. 16. 68-75. 10.9790/487X-161136875.

Moyle, T. L., Dollard, M., & Biswas, S. N. (2006). Personal and Economic Empowerment in Rural Indian Women: A Self-help Group Approach. International Journal of Rural Management, 2(2), 245–266.

Panda, Debadutta & Atibudhi, H.. (2010). Impact of group-based microfinance on rural household income: Evidence from an Indian state. Journal of Rural Cooperation. 38. 173-186.

Sahu, Ananta Basudev; and Das, Sandhya Rani, (2007), “Women Empowerment Through Self-help Groups: A Case Study”, Paper Presented at a Seminar on Gender Issues and Empowerment of Women.

Singh, Devendra (2019) A Critical Study of Micro Finance Institutions & It's Growth in India, Amity International Journal of Juridical Sciences (Vol. 5, 2019) Pp. 88-94.

Varghese, Thresi. (2011). Women Empowerment in Oman: A study based on Women Empowerment Index. 2. 37-53.

Yunus, Muhammad, 2003. Banker to the poor; Micro-Lending and the Battle against world poverty New York: Public Affairs.

Downloads

Published

Issue

Section

License

Copyright (c) 2021 Dr. Himanshu Agarwal, Dr. Sarfraj Ahmed

This work is licensed under a Creative Commons Attribution 4.0 International License.